Week 1: Check Fraud

9/21/2018

2 min. read

By: FCU Team

In 2017, nearly 30,000 fake-check complaints were reported to the Better Business Bureau, resulting in losses of almost $38 million. You would think, that with all of the high tech gadgets fraudsters have at their disposal, that check fraud would be a thing of the past. Nevertheless, you’d be wrong. The BBB reports a resurgence of check fraud starting in 2016, and it has been on the rise ever since.

One of the reasons check fraud is so common is because there are so many different ways it can rear its ugly head. Before the rise of the internet, the most common cases of check fraud dealt with kiting, forgery, and alterations. Moreover, while advances in technology have presented criminals with more opportunities to target unsuspecting victims, it doesn't mean they won't try the old methods.

While it is never your fault if you become a victim of fraud, it is known that criminals;tend to actively seek out victims. If you're selling something online, active on an online dating site, or maybe just looking for ways to make quick cash, criminals could potentially view you as a target. For this reason, students and the elderly tend to be targeted more often than others.

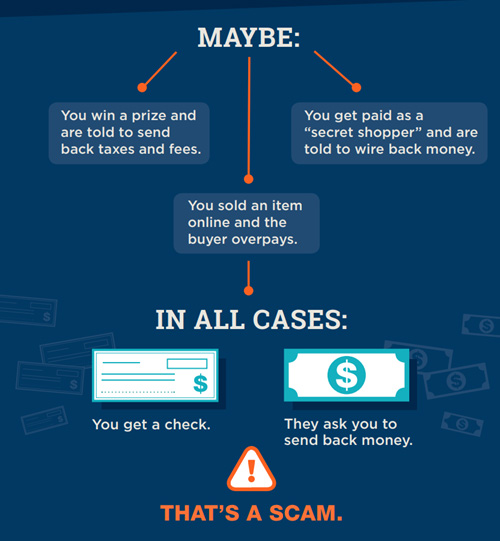

A dead giveaway of this type of scam is that the fraudster will require that you send money back to them after depositing their fake check. Read two common examples below:

- You receive a letter in the mail that you’ve been selected to win a prize. Enclosed is a check for $5,000.00. All you have to do is deposit the check and send back payment for taxes and fees for your prize.

- You sell an item online and the buyer overpays. They send you a counterfeit check for a few hundred dollars over your asking price. They apologize for their error and ask you to take your money and return the overage back to them.

In both of these instances, once you have deposited the fraudulent check, the financial institution has to make the funds available within a certain timeframe. This could be up to 10 business days. However, it might sometimes take even longer for the check to be returned. By the time the bank is aware that the check is no good the criminal has already received your payment and you're responsible for recovering the funds for the bad check.

Keep in mind that it could take some time for a check to be returned to your financial institution. Credit unions and banks are required to release funds within a reasonable amount of time, as specified by law. However, that does not always mean the coast is clear. For that reason, it is extremely important avoid using funds until you are sure the check is legitimate.

There are ways that you can prevent check fraud and protect yourself:

- Avoid sending checks in the mail

- Always keep checks/checkbooks in a safe, secure place

- Be wise about online activity

- Something seem fishy? Consult with your financial institution before sending money to a stranger

In the event that you do become a victim of check fraud, it is vital to take the appropriate steps to attempt to rectify the situation. Report the crime to your financial institution and also let the BBB, and Federal Trade Commission know. Since most of these scam rings occur on the international level there are thousands of cases open at any given time. The details you provide could help the FTC track down the responsible parties and bring them to justice.

Sources:

https://www.consumer.ftc.gov/sites/www.consumer.ftc.gov/files/fake_check_scams_infographic_final.pdf

http://www.ckfraud.org/ckfraud.html