Celebrating School Staff with Better Banking

As another school year kicks off, Florida Credit Union is here help make your financial life a breeze. We've been proud supporters of teachers for over 70 years with top-notch products, convenience, and personalized service.

To show our appreciation, we've got some pretty special back-to-school offers lined up just for you!

$300 Cash Bonus¹

Start the school year out right with some extra cash in your pocket! For a limited time, when you open an FCU Full-Service Checking Account with direct deposit, you'll receive a $3001 cash bonus!

- No minimum balance

- No monthly fee

- Free Visa® debit card with contactless tap-to-pay technology

- Free online and mobile banking

To qualify, make a single or combined direct deposit of $500 made to this account within 60 days of opening and keep your account open and in good standing for at least 90 days Use offer code: 26CHK300

Drive into the School Year with Savings

Whether you're cruising to school in a new ride or refinancing your car for extra savings every month, we've got you covered with competitive rates, flexible payment terms, and a speedy online application process.

- Make no payments for 90 days2

- Ask how we can match or beat your current rate

- 100% financing available

- And earn up to $4003 back when you refinance your auto, boat, or RV loan with us. Use promo code: AUTO26

Smart Spending Starts with Our Educator-Friendly Credit Card

Whether it’s for everyday expenses or big purchases, we have the card for you! Pick the perks that best match your lifestyle: cash back, points, low rates, or rebuilding credit.

- Select™ Visa Signature® Card

- No annual fee on most cards4

- Online account management

- Extra security features such as card lock and unlock

Perfect for those who pay off their monthly balance and want to maximize cash back on everyday purchases.

Learn MoreFor those who enjoy multiple reward options, including cash back, gift cards, merchandise, event tickets, and more.

Learn MoreNot interested in rewards? Our lowest rate credit card helps minimize interest payments and offers a fixed rate.

Learn MoreNeed to boost your credit? This is our best card for those building or rebuilding their credit.

Learn MoreMortgages, Refinancing, and Home Equity Options

As a school employee, you work tirelessly to inspire and shape the lives of others. At Florida Credit Union, we believe you deserve a home that serves as your personal haven and a financial solution that supports your dreams.

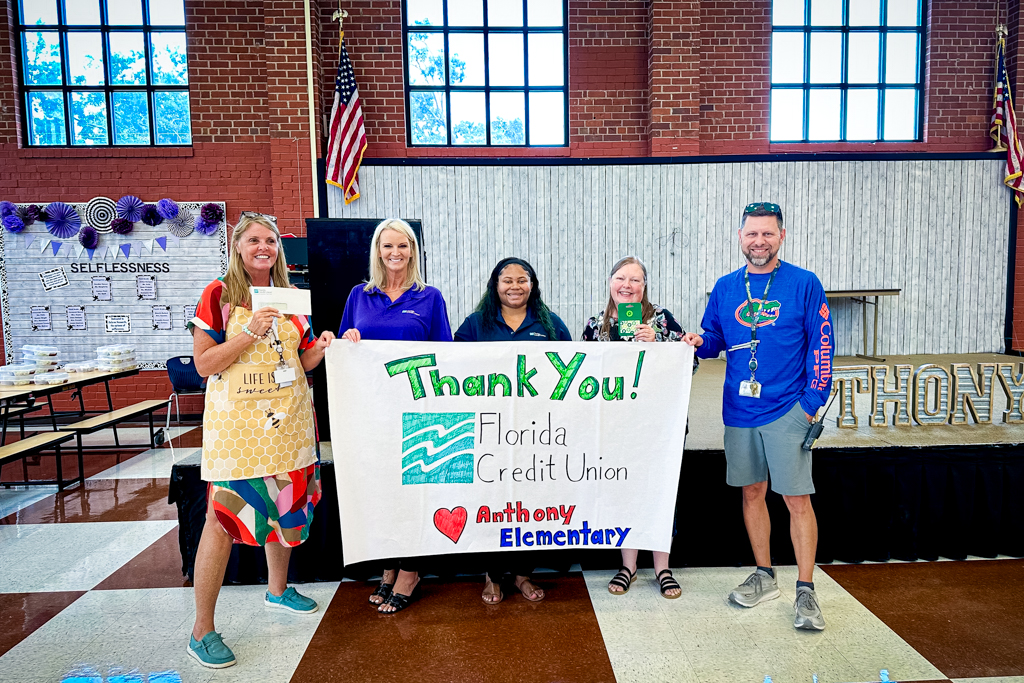

Save more with FCU Local Heroes®

Through our FCU Local Heroes® program teachers can receive a $5755 lender credit at closing when applying for their first mortgage. It’s our way of saying thank you for shaping the future of our communities by helping you achieve your dream of homeownership.

Savings Account Options for Every Stage of Life

We all have unique savings goals. That's why FCU offers a variety of savings account options designed to help you and your loved ones build a strong financial foundation.

- Holiday Club Savings Account: Save for holiday expenses year-round. Then have your balance automatically transferred to your account6 in November, just in time for holiday shopping!

- Vacation Club Savings Account: Plan ahead for your vacation. Start saving regularly and receive half your balance June and the other half July.7

- Youth Savings Account: It’s never too early to teach your child financial skills. Our growth-focused account offers kids 17 and under a 2% APY8 on balances up to $750, with no monthly fees.

Knowledge is Power!

Check out our online resources!

Learning doesn’t stop when the school day ends, which is why we’ve built tools to help you learn about a variety of subjects beyond the classroom. Learn about:

- Interactive Financial Education - explore common financial topics

- eFraud Prevention - fraud prevention resources

- Digital Academy - watch our educational videos about Financial literacy, card management, online banking, and much more

- Branch Services - find out about what each of our branches offer

DISCLOSURES

1. Offer can be canceled at any time. Free membership is open to anyone within Florida Credit Union’s 48 county field of membership. Anyone who has held a checking account with FCU in the past 24 months will not qualify for the incentive. Must be 18 years old or older to qualify. One per household. Credit approval and initial $5 open deposit required. $500 cumulative direct deposit amount must be made to this account within the first 60 days of account opening. Your direct deposit needs to be an electronic deposit of your paycheck, pension, or government benefit (such as SSI) from your employer or the government. Person-to-person payments (such as Cash App, Venmo, or PayPal) are not considered a direct deposit. If the requirements are met and the account remains open and in good standing for 90 days, the $300 will be credited to the account. $300 is considered interest and will be reported on IRS form 1099-INT.

2. Offer for auto, SUV, and truck loans only. Payments may be deferred for the first 90 days; interest accrues from inception. Subject to credit approval.

3. Existing FCU vehicle loans are not eligible for refinancing. Rebate based upon total loan amount.

4. $100 annual fee on Fresh Start Card. Subject to credit approval. Offer subject to change at any time. Full card agreements are available here.

5. “FCU Local Heroes®” lender credit program: Available to first responders, teachers, licensed medical professionals, and military personnel (active and veterans) for a first mortgage purchase or refinance application. Eligibility requirements apply. Second and investment residences not eligible. This program offers a credit at closing of $575. This offer is subject to change without notice. Other terms and conditions may apply. Available for new applications submitted on 1/1/2025 and forward.

6. Funds are directed to your Regular Savings. Member can request the transfer be to another account like Checking.

7. In June, up to $1000 of the balance will be transferred to your Regular Savings. In July the remainder of the account is withdrawn. Member can request the transfer be to another account like Checking.

8. Annual Percentage Yield (APY) is effective as of 02/19/2026 and subject to change at any time. Balances $750 and above will earn 0.15% APY. Fees may reduce earnings. $5 share savings account required for membership. One account per qualified youth member. Learn more about membership eligibility requirements.