How to Compare Checking Accounts and Pick the Best One for You

9/20/2024

15 min. read

By: FCU Team

Let's face it — choosing a checking account isn't exactly thrilling. The good news? You don't need a finance degree to make a smart choice. At Florida Credit Union, we've done the legwork and put together this straightforward guide to help you sort through the clutter and find an account that actually works for you.

Whether you're a college student, a busy professional, or somewhere in between, we've got you covered. We'll break down the different types of accounts out there, compare banks and credit unions, and give you the inside scoop on what really matters when it comes to your everyday banking. By the time you're done reading, you'll know exactly what to look for and what questions to ask. So, grab a cup of coffee (or your beverage of choice), and let's dig in. Your future self will thank you for taking the time to get this right.

Types of Checking Accounts

When comparing checking accounts, it's essential to understand the various types available. Each type caters to different financial needs and lifestyles. Let's explore the most common types of checking accounts you're likely to encounter:

Basic Checking Accounts

- Basic checking accounts are the most straightforward option for everyday banking needs. These accounts typically offer:

- Low or no minimum balance requirements

- Basic features like check writing and debit card access

- Limited or no interest earnings

While basic checking accounts are often free, some may charge a monthly maintenance fee if certain conditions aren't met, such as maintaining a minimum balance or setting up direct deposit.

Interest-Bearing Checking Accounts

For those looking to earn some return on their account balance, interest-bearing checking accounts offer:

- The ability to earn interest on your balance

- Higher interest rates compared to basic checking accounts

- Potentially higher minimum balance requirements

Remember, the interest rates on these accounts are usually lower than savings accounts or certificates of deposit (CDs). However, they provide more flexibility in accessing your funds while offering some earnings.

Student Checking Accounts

Tailored for college and high school students, these accounts often feature:

- Low or no minimum balance requirements

- Waived or reduced monthly fees

- Educational resources on financial management

Potential for linked savings accounts to encourage saving habits

Student checking accounts are an excellent way for young adults to build their financial literacy and establish a banking relationship early on.

Premium or Rewards Checking Accounts

These accounts are designed for customers who maintain higher balances or have multiple accounts with the same institution. Features may include:

- Higher interest rates on balances

- Waived ATM fees, even at out-of-network ATMs

- Discounts on other banking products like loans or safe deposit boxes

- Rewards programs offering cash back or points on debit card purchases

While these accounts often come with more perks, they typically require higher minimum balances or may charge higher monthly fees if requirements aren't met.

Second Chance Checking Accounts

For individuals with past banking issues, such as involuntary account closures, second-chance checking accounts provide an opportunity to re-establish a banking relationship. These accounts usually offer:- Basic checking features with some limitations

- Higher fees compared to standard checking accounts

- The opportunity to graduate to a standard account after a period of responsible use

While not ideal for everyone, these accounts can be a stepping stone to rebuilding your banking history and accessing more favorable account options in the future.

Comparing Financial Institutions

When choosing a checking account, it's not just about the account features – the financial institution you select plays a crucial role in your overall banking experience. Let's compare the main types of financial institutions and their pros and cons:

Big Banks

Pros:

- Extensive branch and ATM networks, often nationwide

- Comprehensive range of financial products and services

- Advanced online and mobile banking platforms

- 24/7 customer support

Cons:

- Higher fees for many services

- Lower interest rates on deposit accounts

- Less personalized customer service

- Stricter requirements for waiving monthly fees

Big banks like Chase, Bank of America, or Wells Fargo offer convenience and various services. However, they may not always provide the most competitive rates or fee structures.

Community Banks

Pros:

- More personalized customer service

- Strong ties to the local community

- Potentially lower fees and better interest rates

- Faster decision-making on loans and other services

Cons:

- Limited branch and ATM networks

- Fewer product offerings compared to big banks

- Less advanced online and mobile banking platforms

- Limited hours of operation

Community banks excel in providing a personalized banking experience and supporting local economies. They can be an excellent choice for those who value relationship banking and are primarily based in one geographic area.

Credit Unions

Pros:

- Member-owned, not-for-profit structure often leads to better rates and lower fees

- Personalized service and community focus

- More flexible lending criteria

Cons:

- Membership requirements (though often broad)

- Fewer branches and ATMs compared to big banks

- May offer a smaller range of products and services

- Technology may lag behind larger institutions

Credit unions, like Florida Credit Union, offer a unique blend of community focus and member benefits. Our not-for-profit status often translates to more favorable terms for account holders. While some credit unions may lag in technology or services, Florida Credit Union is an exception. We offer technological capabilities and a range of services comparable to big banks, combining the advantages of a credit union with the conveniences of larger financial institutions.

Online Banks

Pros:

- Higher interest rates on checking and savings accounts

- Lower fees due to reduced overhead costs

- User-friendly online and mobile banking platforms

- Often offer ATM fee reimbursements

Cons:

- No physical branches for in-person services

- Cash deposits can be challenging

- Limited product offerings compared to traditional banks

- Lacks personal touch and individualized customer service

Online banks have gained popularity for their competitive rates and low fees. They're an excellent option for tech-savvy individuals who are comfortable managing their finances online.

When comparing these institutions, consider your banking habits and priorities. Do you value in-person service and a wide range of products? A big bank or local credit union might be your best bet. Are you focused on earning the highest interest rates and minimizing fees? An online bank could be the way to go.

Remember, you're not limited to choosing just one type of institution. Many people find that a combination – such as maintaining a checking account with a local credit union and a high-yield savings account with an online bank – best serves their financial needs.

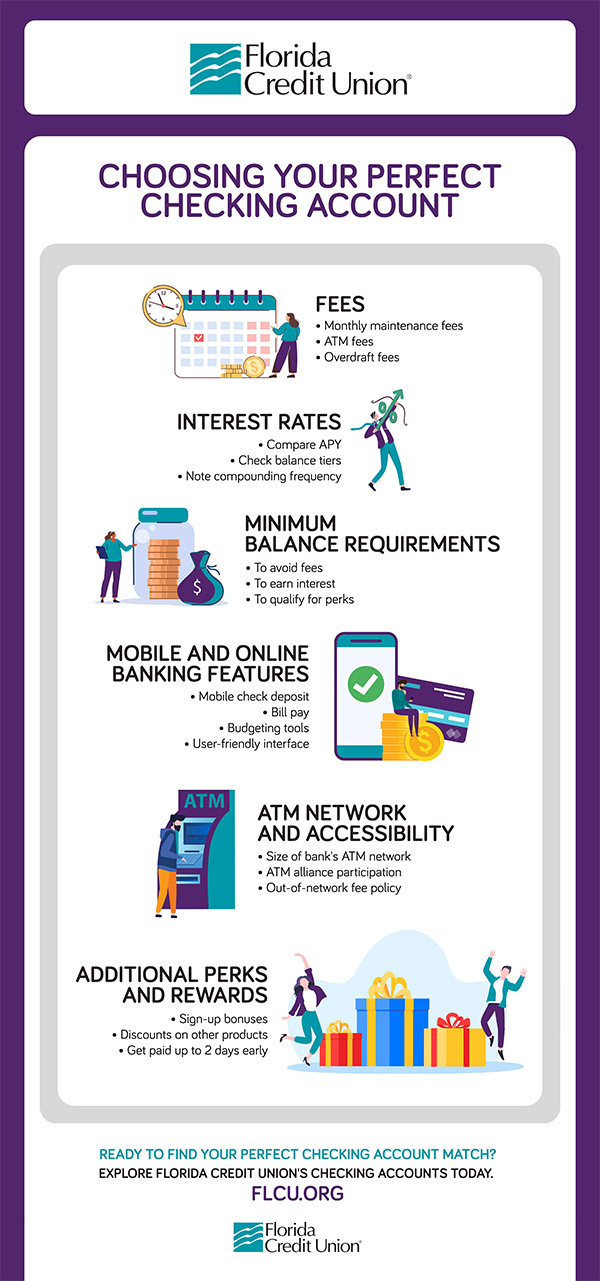

Key Factors to Consider When Comparing Checking Accounts

Several key factors can significantly impact your banking experience and financial health when evaluating checking accounts. Let's explore these in detail:

Fees

Fees can quickly erode your account balance if you're not careful. Pay close attention to:- Monthly maintenance fees: Many accounts charge a monthly fee unless you meet certain requirements, such as maintaining a minimum balance or setting up direct deposit. Look for accounts waiving these fees or make it easy to avoid them.

- ATM fees: Consider how often you use ATMs and whether the bank charges for out-of-network withdrawals. Some institutions offer ATM fee reimbursements, which can be valuable if you frequently use ATMs outside your bank's network.

- Overdraft fees: These can be substantial, often around $35 per occurrence. Look for accounts offering overdraft protection or the ability to link to a savings account for automatic transfers.

Interest rates

While checking accounts typically offer lower interest rates than savings accounts, some do provide the opportunity to earn on your balance:

- Compare Annual Percentage Yields (APY) across different accounts.

- Be aware of any balance tiers affecting the interest rate.

Consider whether the interest is compounded daily, monthly, or quarterly.

Minimum balance requirements

Some accounts require you to maintain a minimum balance to:

- Avoid monthly fees

- Earn interest

- Qualify for certain perks

Ensure you can comfortably meet these requirements to maximize the benefits of your chosen account.

Mobile and online banking features

In today's digital age, robust digital banking tools are essential. Look for:

- Mobile check deposit: This feature lets you deposit checks using your smartphone camera.

- Bill pay: Easily manage and schedule payments directly from your account to billers.

- Account management tools: Features like spending categorization, budgeting tools, and savings goals can help you better manage your finances.

- User-friendly interface: The platform should be intuitive and easy to navigate.

- Fraud Protection: Features such as transaction alerts, low balance notifications and login alerts help you stay informed about account activity and quickly detect any suspicious transactions.

ATM network and accessibility

Consider:

- The size and reach of the bank's ATM network

- Whether the bank participates in any ATM alliances for expanded fee-free access

- The bank or credit union’s policy on out-of-network ATM fees and reimbursements

Additional perks and rewards

Some checking accounts offer extra benefits possibly aligning with your needs:

- Cash back on debit card purchases

- Sign-up bonuses for new accounts

- Discounts on other bank products or services

- Identity theft protection or cell phone insurance

When weighing these factors, prioritize what matters most to you. For instance, extensive ATM access might be less important than robust mobile banking features if you rarely use cash. If you maintain a high balance, an account with tiered interest rates could be more beneficial.

Florida Credit Union’s Standout Features

Florida Credit Union (FCU) offers a comprehensive suite of features designed to meet the diverse needs of its members. Our commitment to personalized service is at the heart of our offerings, evident in our network of localized branches. These physical locations provide members face-to-face interactions, allowing in-depth discussions about financial needs and personalized advice. This local presence is complemented by FCU's robust digital tools, which include a user-friendly mobile app and online banking platform. These digital solutions enable members to manage their accounts, transfer to and from external accounts for free, deposit checks, pay bills, and access various financial management tools from the comfort of their homes or on the go.

As a credit union, FCU's community focus sets it apart from traditional banks. The member-owned structure often translates to more favorable rates and lower fees. Our commitment to the community extends beyond banking services, with the institution actively participating in local events and initiatives. Our dedication to financial education further enhances this community-oriented approach, offering workshops, online resources, and one-on-one counseling to help members improve their financial literacy.

We also provide a range of competitive checking account options to suit different needs, from basic no-frills accounts to interest-bearing and premium accounts with additional perks. Members can enjoy benefits such as ATM fee reimbursements and discounts on other financial products, making FCU a compelling choice for those seeking a balance between traditional banking services and modern financial solutions.

Another valuable perk for FCU members is free monthly access to their credit score. When members open an account and sign up for online banking, they gain this additional benefit, allowing them to regularly monitor their credit health without any extra cost.

Steps to Compare and Choose the Right Checking Account

Selecting the perfect checking account requires a methodical approach, beginning with a thorough self-assessment. Take time to evaluate your banking habits and financial needs.

Self-Assessment

Considerations:

- Frequency of cash withdrawals

- Preference for debit card purchases or online bill pay

- Average monthly balance

- Need for physical branch visits

Once you understand your needs, it's time to research. Cast a wide net by exploring options from various financial institutions, including traditional banks, credit unions, and online banks.

Research

Pay attention to fee structures, minimum balance requirements, interest rates, and special perks or rewards programs.

Estimate potential fees with our interactive fee calculator based on your banking habits.

Consider the level of community involvement and personal attention offered by local institutions compared to larger national banks.

As you narrow down your options, reading the fine print carefully is crucial. Banks and credit unions must provide a standardized fee disclosure, which can be invaluable in your comparison.

Fine Print

Tips:

- Review the standardized fee disclosure for potential fees

- Ask for clarification on any unclear policies

- Discover how bundling accounts can maximize your benefits with our detailed guide

Consider the potential benefits of bundling accounts with a single institution. Many banks and credit unions offer perks for customers who maintain multiple accounts or meet certain balance thresholds across all their accounts.

Bundling Accounts

Advantages:

- Fee waivers on checking accounts

- Better terms and streamlined financial management

- Access to additional perks

As you're making your decision, don't overlook new account promotions. Many financial institutions offer cash bonuses or other incentives to open a new checking account and meet certain requirements

New Account Promotions

Incentives:

- Cash bonuses for setting up direct deposit

- Incentives for maintaining a minimum balance for a specified period

Remember, choosing a checking account isn't just about finding the best deal today – it's about finding a financial partner to grow with you over time.

Long-Term Considerations

Factors:

- Reputation of the institution

- Quality of customer service

- Track record of adapting to new technologies and changing consumer needs

Tips for Managing Your New Checking Account

Set Up Direct Deposit

- Follow our step-by-step guide to quickly and easily set up direct deposit.

- Ensure your money is available quickly and reliably.

- Qualify for certain account perks or fee waivers.

Regular Account Monitoring

- Check your account activity at least weekly, if not daily.

- Use online banking platforms and mobile apps to monitor your balance and transactions.

- Stay informed about unauthorized charges or errors.

Utilize Mobile Banking Features

- Mobile Check Deposit: Deposit checks from anywhere using your smartphone camera.

- Bill Pay Services: Schedule and manage payments directly from your account.

- Budgeting Tools: The mobile app offers spending analyzers and budgeting tools to help users track expenses and make informed financial decisions.

Avoid Overdraft Fees

- Track Your Balance: Monitor your account balance and pending transactions.

- Set Up Alerts: Enable low balance alerts through your bank's mobile app or email notifications.

- Overdraft Protection: Link your checking account to a savings account or line of credit to cover overdrafts.

- Maintain a Buffer: Keep a small amount of extra money in your account to cover unexpected expenses.

- Explore Additional Features Sub-Accounts or "Pockets": Create sub-accounts within your main checking account for budgeting or saving for specific goals.

- Round-Up Savings: Use features to round up debit card purchases to the nearest dollar, automatically transferring the difference to a savings account.

Stay Informed

- Monitor Changes: Read any communications from your bank carefully regarding updates to account terms or features.

- Reassess Periodically: Regularly evaluate your account to ensure it meets your needs.

- Consider Switching: If your banking habits change, speak with your bank about switching to a different account type.

Achieving Financial Stability Through Smart Banking Choices

As we've explored throughout this guide, selecting and managing the right checking account is crucial in your journey toward financial stability and success. By carefully assessing your needs, comparing options, and utilizing the features of your chosen account, you're setting yourself up for a more secure financial future.

Your checking account is more than just a place to store your money – it's a tool to help you budget effectively, save for your goals, and make informed financial decisions. Whether you opt for a traditional bank, a community-focused credit union like Florida Credit Union, or an online banking platform, finding an account to match your unique financial situation and goals is key.

As you progress in your banking journey, don't hesitate to reassess your needs periodically. Your financial situation may change over time, and what works for you today might not be the best fit a year from now. Stay informed about new account offerings and banking technologies that could benefit you.

With the knowledge to make an informed decision, it's time to take action. We invite you to explore the checking account options offered by Florida Credit Union. Our team is committed to providing personalized service and innovative financial solutions to help you achieve your financial goals.

Visit our resources page to view our range of checking account options. Whether you're looking for a basic account with no frills, an interest-bearing account to help your money grow, or a premium account with added perks, we have options to suit your needs.