Home equity loan guide

Home Equity Loans: The Educational Guide You’ve Been Missing

Loans

Home Financing

Debt

8/9/2023

18 min. read

By: FCU Team

Whether you own a beachside condo or a two-story house in the suburbs, your home is one of your most valuable assets. In fact, Florida had the highest increase in home prices between the first quarter of 2021 and the first quarter of 2022 according to the Federal Housing Finance Agency. Home values increased the most in Fort Myers and Cape Coral, soaring by more than 41% in just one year.

Homeownership has several benefits, including tax breaks, more control over your housing costs and the sense of belonging that comes from putting down roots in a community. Best of all, purchasing a home gives you an opportunity to build wealth. As you pay down your mortgage, you build equity, increasing your net worth and leaving you on firmer financial footing.

Once you have enough equity, you can apply for a home equity loan, making it easier to manage your finances. A home equity loan is a type of loan that uses your equity as collateral. In banking terms, collateral is any asset used to secure a loan. If you don’t make payments as agreed, your financial institution can take the collateral, sell it, and use the proceeds to cover the remaining balance. You can use the loan funds for almost anything, including:

● Paying college tuition

● Consolidating credit card debt

● Starting a new business

● Taking a vacation

● Making home repairs

● Paying for a wedding or other special event

● Buying a camper or recreational vehicle

● Lower interest rates: Because home equity loans are backed by collateral, they typically come with lower interest rates than other financial products.

● Long repayment terms: Your financial institution may give you as long as 30 years to repay your home equity loan, keeping your monthly payments low.

● Predictable payments: Your payment amount remains the same every month, making it easier to manage your finances.

● Tax breaks: If you take out a home equity loan, you may be able to deduct the interest on your federal tax return, reducing your overall tax burden.

● Potential loss of home: If you use your home as collateral for a loan, you must make your payments as agreed. Otherwise, the lender can take your property and sell it.

● Closing costs: You may have to pay closing costs, typically ranging from 2% to 5% of the loan amount, increasing your total cost of borrowing.

● Monthly payments: Once you take out a home equity loan, you’ll have to make monthly payments. If you still have a mortgage, you’ll have to make both payments every month, increasing your monthly expenses.

● Equity requirements: Many lenders require that you have at least 15% to 20% equity in your home. If you have less than that, you may not qualify for a home equity loan.

● Borrowing qualifications: To get a home equity loan, you must have a good credit score and a low level of debt. If you don’t meet these requirements, you may have to apply for a different type of credit.

Banks and credit unions use your LTV ratio to determine if you're likely to default on a loan. LTV also affects your loan terms, including the amount of your monthly payment and closing costs. If your LTV ratio is higher than it should be, you have three options for increasing your home equity.

● Wait to apply until your mortgage balance is low enough to satisfy your lender's minimum LTV requirement. If possible, make extra principal payments each month to achieve your target LTV as quickly as possible.

● Wait until your home's value increases. In the United States, home values have increased every year since 2012, so there's a good chance yours will go up if you're patient.

● Make a large principal payment on your first mortgage. This reduces your loan balance, bringing your LTV below the maximum.

Debt-to-income ratio (DTI) is a comparison of your debt payments to your monthly income. To calculate your DTI, add up your minimum payments, divide them by your gross income and multiply the result by 100. If you have $1,000 in monthly minimum payments and $5,000 in monthly income, for example, your DTI is 20%. Most lenders require a DTI no higher than 43%, but a lower DTI is even better since it shows that you have more income available to cover your loan payments.

Finally, you need to show the lender that you earn enough income to make payments on your first mortgage and your home equity loan. The more money you want to borrow, the more income you'll need to earn to satisfy the lender's requirements. Most people use income they earn from a job, but you may be able to qualify with self-employment income, investment income or retirement income.

Some lenders require you to agree to a minimum draw at closing. That means you can't open the HELOC and let it sit there without using it. If you only need a small amount of money, it may be better to take out a personal loan, as you won't have to worry about drawing more than you need to cover your expenses.

For example, if you have three credit cards, a personal loan and an auto loan, you may want to use a debt consolidation HELOC to pay them off. Instead of having five accounts and bills to manage every month, you'll have just one, making it less likely you'll miss a payment. HELOCs also tend to have lower interest rates than credit cards and personal loans, so you may be able to reduce your average interest rate.

● Replacing a damaged roof

● Installing central air conditioning

● Replacing drafty doors and windows

● Creating an addition

● Adding another bathroom

● Adding a porch or a deck

● Installing new siding

As a bonus, completing some of these projects has the potential to increase the value of your home. If you need to take out a home equity loan or HELOC in the future, that could give you more equity to borrow against.

With a home equity loan, you get a lump sum after closing. You can spend as much or as little of it as you want as long as you make the agreed-upon monthly payments. If you open a HELOC, you don't receive a lump sum. Instead, you gain access to a revolving line of credit with a preapproved limit. This makes a HELOC ideal if you want to draw on your home equity multiple times instead of borrowing against it just once.

Another major difference is the way payments are structured. With a credit card, there's no separate draw period followed by a repayment period. Instead, there's a monthly billing cycle. The charges you make during a billing cycle determine your minimum payment for the next month. Many credit cards also offer cashback and other benefits.

Finally, credit cards typically have higher interest rates than HELOCs. This is because unsecured cards aren't backed by any collateral. When there's no collateral, the bank is taking a bigger risk in giving you credit. HELOCs and credit cards usually have variable interest rates, although you may be able to lock in a fixed rate when you first open your account.

Alternatively, you can purchase your scores by visiting the FICO website and choosing the Advanced or Premier package, both of which include scores from Equifax, Experian and TransUnion. These are the three biggest credit bureaus in the United States. If you sign up for a FICO membership and don't want to continue it, remember to cancel before your first month ends. Credit scores have a big impact on your eligibility for a home equity loan or line of credit, so make sure you have at least a 620 (HELOC) or a 680 (home equity line of credit) score. If you don't, there are some steps you take to improve your scores before you apply.

If you're employed, make sure you have at least a year's worth of pay stubs available. These documents show how much money you bring in each month. If you just started a new job or don't have recent pay stubs, your lender may also ask for your tax returns.

Be prepared to provide additional documentation if you're self-employed or living off your investment income. For example, if you're self-employed, gather your financial statements to show how much you have coming in and going out of your business every month. It's also helpful to gather copies of 1099 forms and other tax documents related to your self-employment income.

Additionally, your lender may ask for checking and savings account statements. These documents show how much money comes into and leaves your accounts every month, so they're helpful for verifying you have the financial means to make monthly payments.

If you don't have an existing banking relationship, consider borrowing from a credit union. Like banks, credit unions are heavily regulated, but they offer several advantages over traditional banks. For example, credit unions usually charge lower rates on home equity loans, HELOCs and other types of credit. Credit union staff also provide highly personalized service, making it easier to understand your options.

This risk applies to all types of property, from a two-story house to a townhouse. If you plan to borrow against the equity in a mobile home, you also need to be aware of another risk: low borrowing limits. Mobile homes don't appreciate as much as site-built homes, so it may take longer to get below your lender's maximum LTV. A mobile home may also be worth less than a site-built home in the same neighborhood, limiting the amount you can borrow.

If you plan to borrow against the equity in a mobile home, don't throw in the towel without talking to a loan officer. Your home may appreciate faster if it's well-maintained, if you own the land it's on or if the lot is large. Large mobile homes also appreciate more than small mobile homes, so you may not have to worry about your LTV ratio or your borrowing limit.

If you're not confident in your ability to make payments, consider using a different type of credit or putting off unnecessary spending until you're in a better financial position. One option is to reduce the amount you borrow, which will make the monthly payments more manageable. Another potential risk is that home values will decrease right before you apply for a home equity loan or a HELOC. If they do, you may not be able to borrow as much as planned. This is because a reduction in home value increases your LTV ratio, which may put you over your lender's limit.

Finally, you need to be aware of the effects of variable interest rates. Although most home equity loans have fixed rates, HELOCs usually have variable rates. If your rate increases significantly during the repayment period, your monthly payment may increase way more than you expected, making it more difficult to manage your finances.

Unfortunately, identity theft is also a major concern. In 2022, Americans submitted more than 1.1 million identity theft reports to the Federal Trade Commission (FTC). If someone steals your identity, they can open up credit accounts in your name, run up big balances and never make a payment. This has a big impact on your credit score.

If you believe someone has stolen your identity, file a report with the FTC. Then contact the three major credit bureaus and ask them to put a freeze on your files. A freeze prevents someone with access to your Social Security number and other personal information from opening up new accounts in your name.

If you have a lot of debt, start paying it down as quickly as possible. Paying more than the minimum on each account helps you pay off debt faster and reduces the amount of interest you pay over time. It can also give your credit score a boost.

Therefore, your best bet is to reduce the balance on your mortgage. You can do this by making extra principal payments every month. Even if you don't take out a home equity loan or a HELOC, making extra principal payments will reduce the amount of interest you pay over time, leaving you in a better financial position.

Another option is to get a new job with a higher salary. As long as your new job is in the same field as your old one, it shouldn't hurt you at all to switch employers. It can also help you reduce your DTI, making it easier to qualify for a home equity loan or a HELOC.

One of the biggest benefits of home equity investments is that the qualification requirements aren't as strict as they are for home equity loans and HELOCs. Another advantage of home equity investments is that you don't have to make monthly payments.

The process of getting a home equity investment is similar to the process of getting a loan, except you don't have to worry about having a credit score in the 600s or higher. Once you connect with an investor, they'll send someone to appraise your home. Then the investment company makes an offer, which spells out how much money you'll receive and how much equity you'll have to share.

Finally, you pay the closing fees and sign the home equity investment agreement. You'll receive a single payment, which you can use for anything from college tuition to a new car. Once your term ends, you'll pay back the investor's share of your equity, which is calculated based on your home's current value — not the value of your home when you signed the agreement.

The main drawback of a home equity investment is that you may lose out on a significant amount of money if your home appreciates drastically. Additionally, home equity investments aren't available in every state.

The biggest drawback of a sell-and-stay loan is that there's a chance you won't be in a position to buy back the house. If that happens, you'll have to move out at the end of your rental term. That said, sell-and-stay loans have no minimum credit requirements, so they're easier to obtain than home equity loans and HELOCs.

The main disadvantage of a HELOC is that it reduces the amount of equity you have in your home. You won't get that equity back until you pay off and close the line of credit. As HELOCs usually have variable interest rates, there's a chance the interest rate could increase. Finally, it's easy to run up a large balance without even realizing it, weakening your financial position.

● Your credit history

● Current market conditions

● How much money you earn

● The loan term

You should also shop around for the best rates. Visit several bank and credit union websites to determine where you can get the best deal.

Under the TCJA, you can't deduct any of the interest until after 2025. This could change if Congress amends the TCJA or passes new tax legislation, so contact your accountant for updates.

Homeownership has several benefits, including tax breaks, more control over your housing costs and the sense of belonging that comes from putting down roots in a community. Best of all, purchasing a home gives you an opportunity to build wealth. As you pay down your mortgage, you build equity, increasing your net worth and leaving you on firmer financial footing.

What Is Home Equity?

Home equity is the difference between the value of your home and the balance on your mortgage. For example, if you have a home worth $350,000 and a mortgage balance of $200,000, you have $150,000 in home equity. Building equity is important because it means you’re reducing your debt load and increasing the value of your assets.Once you have enough equity, you can apply for a home equity loan, making it easier to manage your finances. A home equity loan is a type of loan that uses your equity as collateral. In banking terms, collateral is any asset used to secure a loan. If you don’t make payments as agreed, your financial institution can take the collateral, sell it, and use the proceeds to cover the remaining balance. You can use the loan funds for almost anything, including:

● Paying college tuition

● Consolidating credit card debt

● Starting a new business

● Taking a vacation

● Making home repairs

● Paying for a wedding or other special event

● Buying a camper or recreational vehicle

Benefits of Taking a Home Equity Loan

Home equity loans have several benefits, making them an attractive option for homeowners. Some of the top advantages of applying for a home equity loan, versus other types of credit, include:● Lower interest rates: Because home equity loans are backed by collateral, they typically come with lower interest rates than other financial products.

● Long repayment terms: Your financial institution may give you as long as 30 years to repay your home equity loan, keeping your monthly payments low.

● Predictable payments: Your payment amount remains the same every month, making it easier to manage your finances.

● Tax breaks: If you take out a home equity loan, you may be able to deduct the interest on your federal tax return, reducing your overall tax burden.

Disadvantages of Taking a Home Equity Loan

For many people, applying for a home equity loan is the best option. Before you apply, however, you should know that this type of loan has a few disadvantages:● Potential loss of home: If you use your home as collateral for a loan, you must make your payments as agreed. Otherwise, the lender can take your property and sell it.

● Closing costs: You may have to pay closing costs, typically ranging from 2% to 5% of the loan amount, increasing your total cost of borrowing.

● Monthly payments: Once you take out a home equity loan, you’ll have to make monthly payments. If you still have a mortgage, you’ll have to make both payments every month, increasing your monthly expenses.

● Equity requirements: Many lenders require that you have at least 15% to 20% equity in your home. If you have less than that, you may not qualify for a home equity loan.

● Borrowing qualifications: To get a home equity loan, you must have a good credit score and a low level of debt. If you don’t meet these requirements, you may have to apply for a different type of credit.

How Do Home Equity Loans Work?

A home equity loan works like a second mortgage. When you have two mortgages, your original lender is the primary lienholder. That means they're first in line to get the property if you default on your loans. In the event of a default, the primary lienholder sells the property. If there's nothing left after paying off your first mortgage, the lender that holds your home equity loan may not get paid.Types of Home Equity Loans

Most home equity loans are fixed-rate loans, which means the interest rate stays the same for the life of the loan. With a fixed-rate loan, you don't have to worry about your loan rate increasing as interest rates change. That makes it easier to plan ahead. Home equity lines of credit are also classified as home equity loans, but they don't work quite the same way.Maximum Loan-to-Value Ratio

To qualify for a home equity loan, you must satisfy your lender's minimum loan-to-value (LTV) ratio. This metric compares the balance on your mortgage with the appraised value of your home. For example, a home with a mortgage balance of $200,000 and an appraised value of $400,000 has a 50% LTV ratio. In most cases, you need an LTV of no more than 85%, although some lenders go up to 90%. That means you need to have at least 15% equity in your home.Banks and credit unions use your LTV ratio to determine if you're likely to default on a loan. LTV also affects your loan terms, including the amount of your monthly payment and closing costs. If your LTV ratio is higher than it should be, you have three options for increasing your home equity.

● Wait to apply until your mortgage balance is low enough to satisfy your lender's minimum LTV requirement. If possible, make extra principal payments each month to achieve your target LTV as quickly as possible.

● Wait until your home's value increases. In the United States, home values have increased every year since 2012, so there's a good chance yours will go up if you're patient.

● Make a large principal payment on your first mortgage. This reduces your loan balance, bringing your LTV below the maximum.

Financial Requirements

When you apply for a home equity loan, LTV is just one piece of the puzzle. The lender also checks your credit score and debt-to-income ratio. Like LTV, your credit score helps lenders determine if you're likely to repay a home equity loan as agreed. Generally, you need a score of at least 680 to qualify, but your lender may have more stringent requirements.Debt-to-income ratio (DTI) is a comparison of your debt payments to your monthly income. To calculate your DTI, add up your minimum payments, divide them by your gross income and multiply the result by 100. If you have $1,000 in monthly minimum payments and $5,000 in monthly income, for example, your DTI is 20%. Most lenders require a DTI no higher than 43%, but a lower DTI is even better since it shows that you have more income available to cover your loan payments.

Finally, you need to show the lender that you earn enough income to make payments on your first mortgage and your home equity loan. The more money you want to borrow, the more income you'll need to earn to satisfy the lender's requirements. Most people use income they earn from a job, but you may be able to qualify with self-employment income, investment income or retirement income.

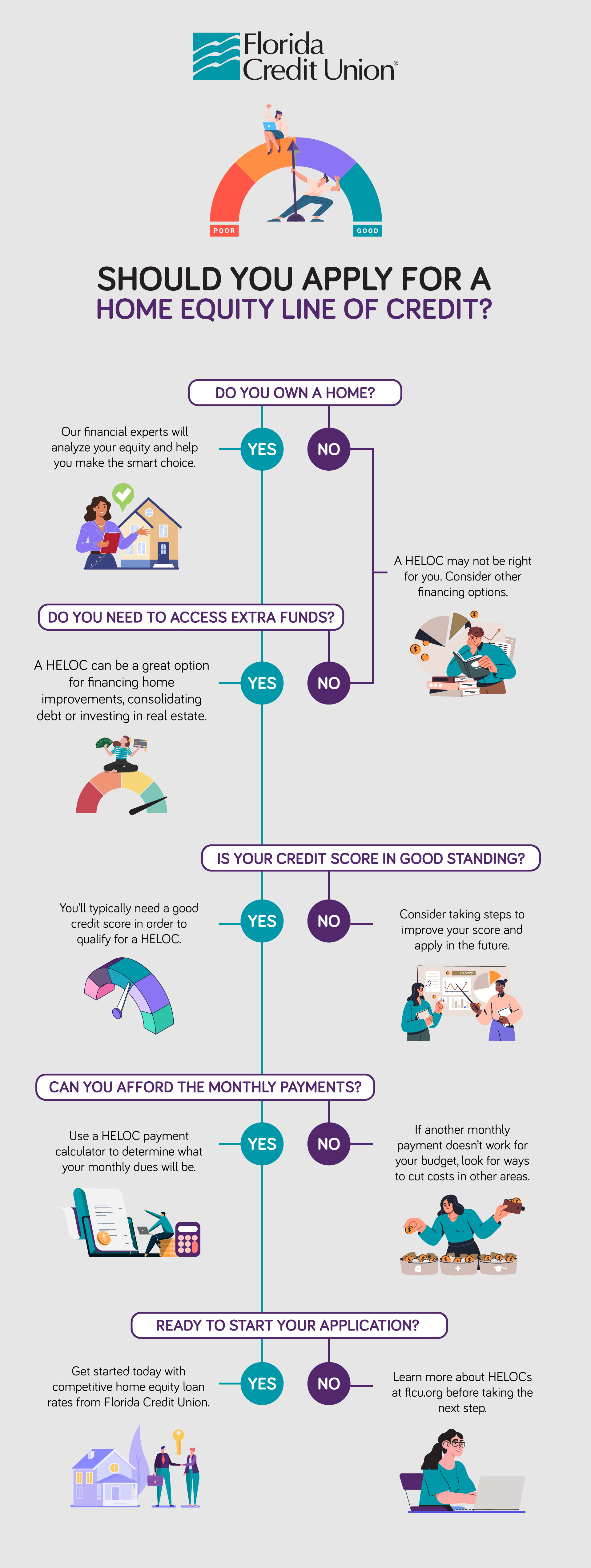

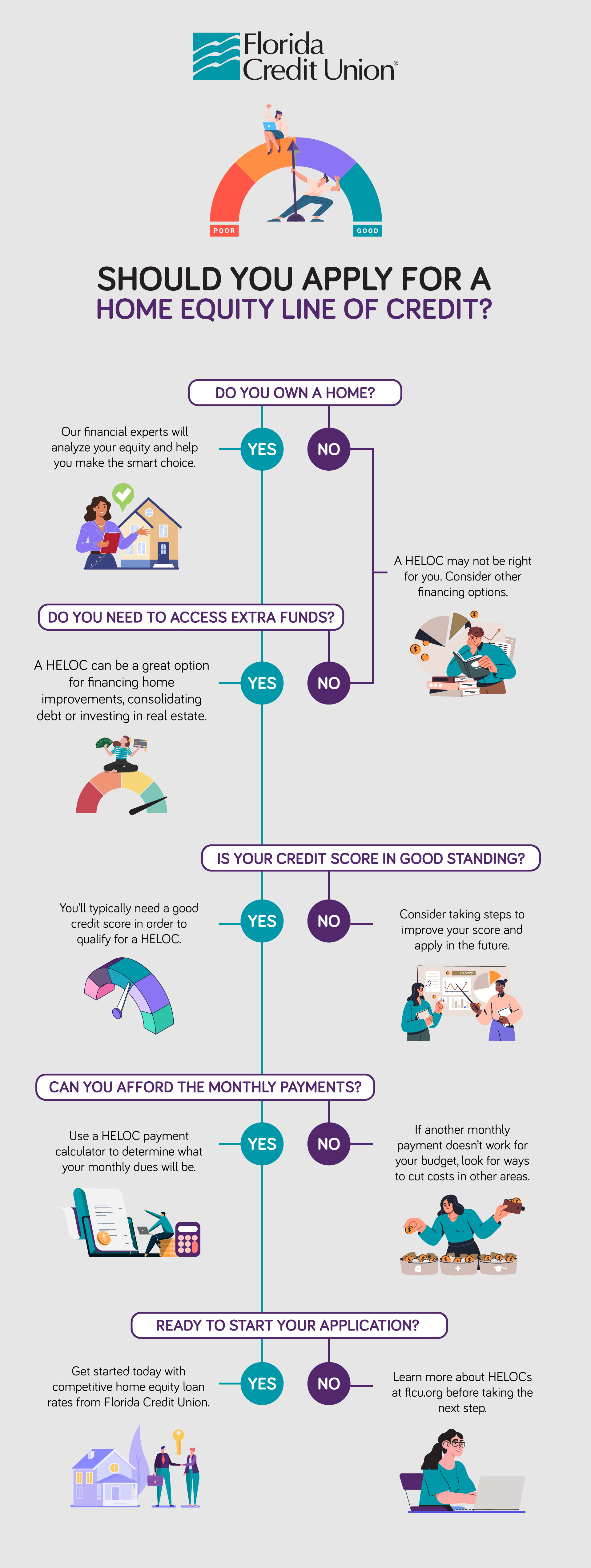

What Is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit backed by the equity in your home. Once you have a line of credit, you can draw from it whenever you need extra cash. Most HELOCs are set up with a 10-year draw period and a 20-year repayment period. During the draw period, you make interest-only payments. When the repayment period begins, you pay back the principal plus interest.Some lenders require you to agree to a minimum draw at closing. That means you can't open the HELOC and let it sit there without using it. If you only need a small amount of money, it may be better to take out a personal loan, as you won't have to worry about drawing more than you need to cover your expenses.

Types of HELOCs

All HELOCs work the same way, but there are several ways to use them. Therefore, you may hear them referred to as debt consolidation HELOCs, home improvement HELOCs or major purchase HELOCs.Debt Consolidation HELOC

A debt consolidation HELOC is a home equity line of credit used specifically for consolidating other debts. Consolidation rolls multiple debts into a single loan or line of credit, reducing your monthly payment amount. This process also makes it easier to stay on top of your finances, as you only have to worry about managing one debt instead of many.For example, if you have three credit cards, a personal loan and an auto loan, you may want to use a debt consolidation HELOC to pay them off. Instead of having five accounts and bills to manage every month, you'll have just one, making it less likely you'll miss a payment. HELOCs also tend to have lower interest rates than credit cards and personal loans, so you may be able to reduce your average interest rate.

Home Improvement HELOC

Whether you need a new roof or want to overhaul your outdated kitchen, a home improvement HELOC can help you cover the costs. Also known as a renovation HELOC, a home improvement HELOC gives you access to a line of credit you can use for major home projects. Here are just a few examples:● Replacing a damaged roof

● Installing central air conditioning

● Replacing drafty doors and windows

● Creating an addition

● Adding another bathroom

● Adding a porch or a deck

● Installing new siding

As a bonus, completing some of these projects has the potential to increase the value of your home. If you need to take out a home equity loan or HELOC in the future, that could give you more equity to borrow against.

Major Purchase HELOC

If you need to make a major purchase that isn't related to home renovation, you can use the line of credit from your HELOC. Examples include buying a car, purchasing a recreational vehicle, paying college tuition or getting an expensive home entertainment system. Since HELOCs are backed by your home equity, they often have lower rates than retail credit cards, which may help you save money.HELOCs vs. Other Types of Credit

If you have plenty of home equity and need to cover a major expense, a HELOC is an attractive option. Before you apply for one, however, you should understand how HELOCs stack up against other types of credit. Here's a look at how they compare to home equity loans, credit cards and personal loans.HELOC vs. Home Equity Loan

Although HELOCs and home equity loans are both backed by equity, there are some key differences between the two credit products. First, home equity loans typically come with fixed monthly payments. In contrast, HELOCs have interest-only payments during the draw period. Therefore, you should expect your minimum monthly payment to increase once the repayment period begins.With a home equity loan, you get a lump sum after closing. You can spend as much or as little of it as you want as long as you make the agreed-upon monthly payments. If you open a HELOC, you don't receive a lump sum. Instead, you gain access to a revolving line of credit with a preapproved limit. This makes a HELOC ideal if you want to draw on your home equity multiple times instead of borrowing against it just once.

HELOC vs. Credit Card

Although a HELOC is a revolving line of credit, it's a bit different from a credit card. You can open a credit card without putting your home equity on the line. Even if you get a secured card, the minimum deposit is low. In contrast, a HELOC usually requires you to have an LTV ratio of at least 85%.Another major difference is the way payments are structured. With a credit card, there's no separate draw period followed by a repayment period. Instead, there's a monthly billing cycle. The charges you make during a billing cycle determine your minimum payment for the next month. Many credit cards also offer cashback and other benefits.

Finally, credit cards typically have higher interest rates than HELOCs. This is because unsecured cards aren't backed by any collateral. When there's no collateral, the bank is taking a bigger risk in giving you credit. HELOCs and credit cards usually have variable interest rates, although you may be able to lock in a fixed rate when you first open your account.

HELOC vs. Personal Loan

Most personal loans are unsecured, so you don't necessarily need collateral to get one. They also have fixed interest rates, making it easier to anticipate your monthly loan payment. One of the main differences between a HELOC and a personal loan is that personal loans generally have lower limits. If you need to pay school tuition, renovate your home or make another large purchase, a personal loan may not cover the entire expense.

Steps to Applying for a Home Equity Loan or HELOC

Home equity loans and HELOCs share a similar application process. Although your bank may have some additional requirements, these are the basic steps involved.1. Determine How Much You Need

Before you apply, think carefully about how much you need. If you want a home equity loan, you'll get a lump sum, so you won't be able to increase the amount later. Running the numbers can also help you determine if you should borrow against your home equity or apply for a different type of credit.2. Request Your Credit Scores

The next step is to request your credit scores. Your lender will pull them again later, but you should look at them now to make sure your credit score is high enough to qualify for a home equity loan or a HELOC. Although there are several scoring models, most lenders use the ones produced by Fair Isaac Corporation (FICO). Many institutions, like Florida Credit Union, provide free monthly FICO score updates to members at no cost. If you’re already an FCU member, you’ll have access to your score via online banking, so you’re already one step ahead.Alternatively, you can purchase your scores by visiting the FICO website and choosing the Advanced or Premier package, both of which include scores from Equifax, Experian and TransUnion. These are the three biggest credit bureaus in the United States. If you sign up for a FICO membership and don't want to continue it, remember to cancel before your first month ends. Credit scores have a big impact on your eligibility for a home equity loan or line of credit, so make sure you have at least a 620 (HELOC) or a 680 (home equity line of credit) score. If you don't, there are some steps you take to improve your scores before you apply.

3. Gather Your Financial Documents

As a reminder, you'll need to show your lender you have enough income to make the payments on your home equity loan or HELOC. You'll also need to prove you have a debt-to-income ratio below the lender's limit.If you're employed, make sure you have at least a year's worth of pay stubs available. These documents show how much money you bring in each month. If you just started a new job or don't have recent pay stubs, your lender may also ask for your tax returns.

Be prepared to provide additional documentation if you're self-employed or living off your investment income. For example, if you're self-employed, gather your financial statements to show how much you have coming in and going out of your business every month. It's also helpful to gather copies of 1099 forms and other tax documents related to your self-employment income.

Additionally, your lender may ask for checking and savings account statements. These documents show how much money comes into and leaves your accounts every month, so they're helpful for verifying you have the financial means to make monthly payments.

4. Find a Lender

Now you need a lender. If you already have a positive relationship with a bank or credit union, consider setting an appointment with a loan officer to find out if the financial institution has a home equity loan or HELOC that meets your needs.If you don't have an existing banking relationship, consider borrowing from a credit union. Like banks, credit unions are heavily regulated, but they offer several advantages over traditional banks. For example, credit unions usually charge lower rates on home equity loans, HELOCs and other types of credit. Credit union staff also provide highly personalized service, making it easier to understand your options.

5. Have Your Home Appraised

To verify that your LTV ratio falls below the lender's limit, you'll need a professional home appraisal. You went through this process when you took out your first mortgage, so there shouldn't be any surprises. As a reminder, an appraisal is an opinion of how much a home is worth. The appraisal report describes the home and explains how it compares to similar homes in the neighborhood.6. Meet the Lender's Requirements

Once you fill out an application and provide supporting documentation, your lender will review everything. You may have to provide additional information if your lender is having trouble determining if you qualify. If your loan officer requests more information, respond quickly to avoid approval delays.7. Go Through the Closing Process

Closing is when you sign the paperwork for your home equity loan or HELOC. You'll also have to pay closing costs, which may include an appraisal fee, credit report fee, title search fee and origination fee. These costs usually range from 2% to 5% of the amount you borrow.Types of Collateral and How They Affect Home Equity Loans

When you apply for a home equity loan, you can borrow against the equity in a single-family home, a multifamily home, a condominium ("condo") unit or a mobile home. Keep in mind that the lender can take your home and sell it if you don't make payments as agreed. If you borrow against the equity on your primary residence, this could leave you without a place to live if you default on your home equity loan.This risk applies to all types of property, from a two-story house to a townhouse. If you plan to borrow against the equity in a mobile home, you also need to be aware of another risk: low borrowing limits. Mobile homes don't appreciate as much as site-built homes, so it may take longer to get below your lender's maximum LTV. A mobile home may also be worth less than a site-built home in the same neighborhood, limiting the amount you can borrow.

If you plan to borrow against the equity in a mobile home, don't throw in the towel without talking to a loan officer. Your home may appreciate faster if it's well-maintained, if you own the land it's on or if the lot is large. Large mobile homes also appreciate more than small mobile homes, so you may not have to worry about your LTV ratio or your borrowing limit.

Risks of Home Equity Loans and HELOCs

Home equity loans and HELOCs have several advantages, but it's important to be aware of the potential risks. If you go into the application process with your eyes wide open, you'll be able to avoid some of the most common mistakes. The main risk of taking out a home equity loan or a HELOC is that you have to use your home as collateral. If you make the agreed-upon payments, there's nothing to worry about. But if you default on a loan or a line of credit, the lender can take your home, sell it and use the proceeds to pay off your balance.If you're not confident in your ability to make payments, consider using a different type of credit or putting off unnecessary spending until you're in a better financial position. One option is to reduce the amount you borrow, which will make the monthly payments more manageable. Another potential risk is that home values will decrease right before you apply for a home equity loan or a HELOC. If they do, you may not be able to borrow as much as planned. This is because a reduction in home value increases your LTV ratio, which may put you over your lender's limit.

Finally, you need to be aware of the effects of variable interest rates. Although most home equity loans have fixed rates, HELOCs usually have variable rates. If your rate increases significantly during the repayment period, your monthly payment may increase way more than you expected, making it more difficult to manage your finances.

How to Work Toward Approval If You've Been Denied

If you're not approved for a home equity loan or a HELOC on the first try, don't panic. There are several things you can do to strengthen your financial profile before you try again. Follow these tips to address the lender's concerns and improve your chances of qualifying the second time around.Increasing Your Credit Score

Several factors affect your credit score, including your payment history and total amount of debt. If your credit score doesn't meet the lender's minimum requirements, go to AnnualCreditReport.com and request reports from Equifax, Experian and TransUnion. Although you have to pay for FICO scores, you're entitled to one free copy of your credit reports each year.Check for Errors

Once you have your reports, check them carefully. The Consumer Financial Protection Bureau reports that about 20% of people have an error on at least one of their three credit reports. Some of these errors stem from simple mistakes, such as an employee transposing two numbers when typing a Social Security number. If you notice any inaccuracies on your reports, file a dispute and keep following up until you get a response from the credit bureau.Unfortunately, identity theft is also a major concern. In 2022, Americans submitted more than 1.1 million identity theft reports to the Federal Trade Commission (FTC). If someone steals your identity, they can open up credit accounts in your name, run up big balances and never make a payment. This has a big impact on your credit score.

If you believe someone has stolen your identity, file a report with the FTC. Then contact the three major credit bureaus and ask them to put a freeze on your files. A freeze prevents someone with access to your Social Security number and other personal information from opening up new accounts in your name.

Adjust Your Spending Habits

Payment history and amounts owed account for 65% of your credit scores, so making changes in these two areas can help you improve your scores enough to qualify for a home equity loan or a HELOC. If you have a history of late payments, commit to paying every bill on time from now on.If you have a lot of debt, start paying it down as quickly as possible. Paying more than the minimum on each account helps you pay off debt faster and reduces the amount of interest you pay over time. It can also give your credit score a boost.

Reducing Your LTV Ratio

Because your LTV ratio has just two components, there are only two ways to reduce it: increase your home's value or reduce the balance on your mortgage. You can increase your home's value by adding a bathroom or doing renovations, but if you had the money for those projects, you probably wouldn't need a home equity loan or a HELOC.Therefore, your best bet is to reduce the balance on your mortgage. You can do this by making extra principal payments every month. Even if you don't take out a home equity loan or a HELOC, making extra principal payments will reduce the amount of interest you pay over time, leaving you in a better financial position.

Lowering Your DTI

To reduce your debt-to-income (DTI), you must increase your income, decrease your monthly debt payments or do a little of both. If you have extra money, focus on paying off one or two of your smallest debts. You'll be able to wipe out their minimum payments without paying huge balances.Another option is to get a new job with a higher salary. As long as your new job is in the same field as your old one, it shouldn't hurt you at all to switch employers. It can also help you reduce your DTI, making it easier to qualify for a home equity loan or a HELOC.

Alternatives to Home Equity Loans and HELOCs

Home equity loans and HELOCs aren't right for everyone. Some people are hesitant to use their homes as collateral, while others don't meet the minimum requirements. If you're in the market for an alternative, consider a home equity investment or a sell-and-stay loan.Home Equity Investments

A home equity investment, also known as a home equity sharing agreement, allows you to give up a portion of your home's future equity. In exchange, you receive a lump sum you can use to cover today's expenses.One of the biggest benefits of home equity investments is that the qualification requirements aren't as strict as they are for home equity loans and HELOCs. Another advantage of home equity investments is that you don't have to make monthly payments.

The process of getting a home equity investment is similar to the process of getting a loan, except you don't have to worry about having a credit score in the 600s or higher. Once you connect with an investor, they'll send someone to appraise your home. Then the investment company makes an offer, which spells out how much money you'll receive and how much equity you'll have to share.

Finally, you pay the closing fees and sign the home equity investment agreement. You'll receive a single payment, which you can use for anything from college tuition to a new car. Once your term ends, you'll pay back the investor's share of your equity, which is calculated based on your home's current value — not the value of your home when you signed the agreement.

The main drawback of a home equity investment is that you may lose out on a significant amount of money if your home appreciates drastically. Additionally, home equity investments aren't available in every state.

Sell-and-Stay Loans

Sell-and-stay loans are another way for homeowners to use their equity to get cash. The difference is that you agree to sell your home and then stay in it as a renter. This gives you access to the cash you need without forcing you to move elsewhere. Generally, sell-and-stay contracts include a repurchase option, which allows you to buy back the house at an agreed-upon price at any time before the rental term ends.The biggest drawback of a sell-and-stay loan is that there's a chance you won't be in a position to buy back the house. If that happens, you'll have to move out at the end of your rental term. That said, sell-and-stay loans have no minimum credit requirements, so they're easier to obtain than home equity loans and HELOCs.

Frequently Asked Questions

It's natural to have questions about using your home equity as a form of collateral. Here are answers to some of the most frequently asked questions about home equity loans and lines of credit.What Are the Pros and Cons of HELOCs?

HELOCs have several advantages over other credit products. As mentioned previously, they typically have lower interest rates than credit cards or personal loans. They're also a little more flexible and allow you to borrow lesser amounts over time, so you are only taking the funds you need when you need them. This in turn helps avoid interest payments and unnecessary debt.The main disadvantage of a HELOC is that it reduces the amount of equity you have in your home. You won't get that equity back until you pay off and close the line of credit. As HELOCs usually have variable interest rates, there's a chance the interest rate could increase. Finally, it's easy to run up a large balance without even realizing it, weakening your financial position.

How Do Lenders Determine the Interest Rate on a Home Equity Loan or HELOC?

When you get a home equity loan or a HELOC, the lender bases the interest rate on these factors:● Your credit history

● Current market conditions

● How much money you earn

● The loan term

How Do I Find the Best Rates on a Home Equity Loan or HELOC?

One of the easiest ways to qualify for a lower rate is to strengthen your credit profile before you apply for a home equity loan or a HELOC. Although you may qualify for a loan or a line of credit with a score in the 600s, the best rates usually go to people with scores in the mid-700s and higher.You should also shop around for the best rates. Visit several bank and credit union websites to determine where you can get the best deal.

How Does a Home Equity Loan or HELOC Affect Your Tax Situation?

The Tax Cuts and Jobs Act of 2017 made some major changes to the way the IRS treats home equity loans and lines of credit. Previously, you could deduct the interest if you used the funds to acquire, build or make improvements to your home.Under the TCJA, you can't deduct any of the interest until after 2025. This could change if Congress amends the TCJA or passes new tax legislation, so contact your accountant for updates.