Early Investment And Savings Habits: Benefits for the Future

5/19/2021

5 min. read

By: FCU Team

If you have minimal disposable income, chances are savings may not be a priority in your life right now. Let’s face it: being financially responsible is much easier said than done. Still, preparing for your future is important, and taking an active role in planning for it is imperative! Read on to see the benefits to saving and investing early in life.

Benefits to Saving and Investing Early

When you are focusing on building your career and funding your current lifestyle, the idea of saving for years down the road may not seem like a priority. But, the sooner you begin planning for retirement and making investments, the more you can optimize your potential for financial returns. Some of the benefits to saving and investing include:

Security in Long-Term Saving

One of the greatest motivators in saving money starts with identifying the kind of lifestyle that you want in the future. Long-term saving allows you to take a slow and steady approach to saving that can result in major returns down the road. Investing in the stock market is one form of long-term investing, but one that’s not without its risks. The ability to take risks in investments comes out of the comfort that you can regain the money in the long term.

Growing Savings with Compound Interest

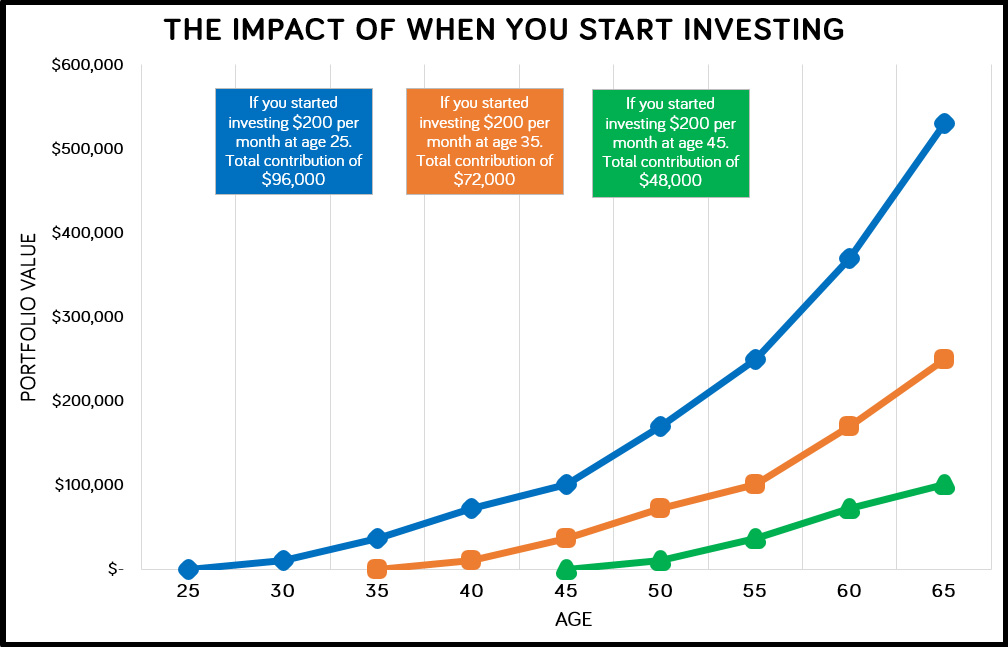

Compound interest is the interest from a bank loan, account, or investment that increases exponentially over time and yields dividends. These dividends can be either reinvested or used for immediate spending. The earlier you contribute funds to an investment or savings account, the more time it has to significantly increase the potential gain from compound interest. If you put small sums into a saving account, such as a 401(k), you can make sizable financial gains over the course of your career.

Put Saving in Focus

When you make saving money a focus of your financial choices, you are likely to develop disciplined spending habits. You can look at your monthly expenses and cut fluff to boost your long-term earning potential. It can be easy to keep saving on the back burner, but by living and saving for the future, you can develop effective, responsible saving habits.

Smart Saving and Investing Habits

One of the most significant challenges in investing is adopting money-saving habits into your daily life. It can be easy to spend your money buying unneeded luxuries, paying for unused subscriptions, or ignoring needs vs. wants. It is essential to develop financially thrifty habits early on. By being deliberate with your spending, you can blend smart money choices into your daily life with ease. Here are some money habits worth picking up.

Start an Investment Portfolio

An investment portfolio is a compilation of stocks, bonds, cash, and funds that encompass an individual's wealth and assets. When starting an investment portfolio, it's vital to ensure that you are diversifying your investments. Diversifying your investment portfolio helps you reduce the risk of significant loss in the stock market, and adapt quickly to any sudden changes in your financial situation.

Decide Your Investment Style

Investing in the stock market is not just for accountants or hedge fund managers. With the growing popularity of quick investment mobile apps, anyone can become financially savvy in the stock market. Before you start investing, take the time to determine your investment style. It would be best to decide how involved you want to be, how much money to invest, and how much risk you’re willing to tolerate. If you are looking for a hands-off approach for investing, look into hiring a trusted financial manager that you can task with completely handling your investment portfolio.

Invest in Stocks to Maximize Earning Potential

A stock is a financial security that represents partial ownership in a company. They are an individual's portion of the company that can share the company's profits and losses. Investing in stocks can be a profitable but risky venture since it’s tied to the overall success of the company.

Invest in Mutual Funds

Mutual funds are a portfolio of investments. Financial experts compile various securities like stocks, bonds, and other assets into a mutual fund, and these can quickly diversify your investment portfolio. By gathering money from various potential investors into one joint mutual fund, you are engaging in a joint venture typically managed by a financial professional. Buying into mutual funds is a great way to engage in the world of investing quickly.

Purchase Bonds for Stability

Another common asset in investment portfolios is buying bonds, which is a fixed income instrument representing a bondsman or investor's loan to a borrower. Governments and corporations typically issue them to raise money. Bonds are a stable element that you can add to your investment portfolio and they are a safe investment that can provide dependable, steady payouts. Buying bonds can also protect your finances from inflation and taxes.

Seek Out a Financial Advisor

It can be challenging to decide where to place your money to ensure that you are taking calculated risks and investing in "safe" assets. Seeking out financial advising services can help you develop smart saving and investing habits. An advisor can help you establish an investment plan, create your portfolio and start a retirement fund.

Our financial advising and investment services can help you navigate the field of investments and help you make wise choices when managing your money.

Put Your Money into Savings

When setting up a savings account, you should weigh the different fees and savings rates at various financial institutions. Unlike banks, credit unions typically offer lower startup fees, higher savings rates, and a local, personable money management experience. Credit unions like Florida Credit Union prioritize their members by design and offer financially beneficial programs to their membership that major banking institutions traditionally do not provide.

Personal Savings Accounts

Whether your savings are for a future car payment, down payment on a home, or in case of emergency, building a solid personal savings account is vital for your financial security. Credit unions are a great place to start your personal savings account, as many credit unions offer a checking account or savings account with no minimum balance or monthly service charges.

Start an Individual Retirement Account (IRA)

An individual retirement account, or IRA, lets you put away money for retirement in a tax-advantaged way. IRAs allow you to take control of your retirement fund, unlike a 401(k), which is only available through an employer sponsored plan. Individual retirement accounts offer tax benefits, and you can open one at any time. An IRA is different from a standard savings account because it incentivizes long-term growth and saving by design. IRAs also penalize early withdrawals as an incentive to promote long-term exponential growth. There are two different types of IRAs: traditional and Roth. Both IRAs provide tax benefits but vary in their upfront incentives. Traditional IRAs give the tax incentive upfront, while a Roth IRAs' tax incentive comes at the time of withdrawal. Learn more about IRAs here.

Stick to the 70/30 Rule

The 70/30 rule is a financial tool used in allocating your monthly income, and applicable to any income bracket. Take your monthly income and put 70% towards monthly expenses. Use 20% of your monthly earnings for savings and any debt, then invest 10% of it towards your retirement. The 20% allocated towards debt and savings allows you to prioritize paying off debts before rising interest rates costs you more time and money. Lastly, this savings plan also has you putting 10% of your monthly earnings towards your future to ensure that you live comfortably later down the road.

Ready to get started? Talk to one of our team members at Florida Credit Union to boost your long-term savings potential today.