Credit Unions vs. Banks

6/26/2018

1 min. read

By: FCU Team

Dissatisfied with their current financial institutions, millions of Americans are searching for different options for their money. What most are finding is that credit unions are the sweet spot of the financial world. Unfortunately, most people just don’t know enough about credit unions to take the final steps into financial freedom. Here are a few of the most common misconceptions consumers have about credit unions today.

Membership Requirements

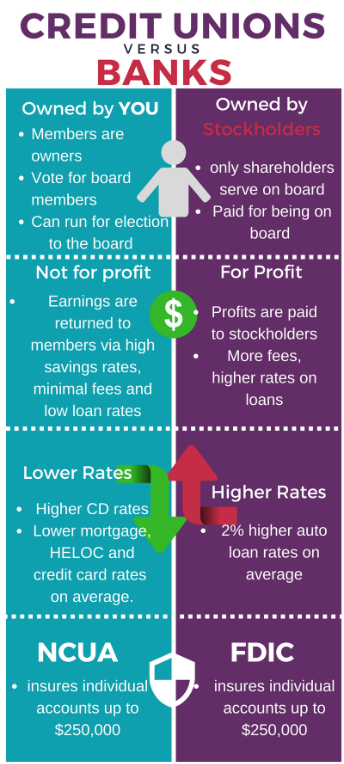

The major difference between a bank and a credit union is the people who own it. Banks are corporations that pay earnings to shareholders while credit unions are member owned cooperatives that share their returns with members (owners) in the form of competitive rates for savings, CDs, loans, mortgages, etc.

And contrary to popular belief, credit unions don’t require a secret handshake to join. Since Florida Credit Union operates on community charter, living or working in a county that we serve means you can apply for membership!

Profits

Since banks are profit driven institutions they have to factor shareholder profits into their business model, and in turn typically charge customers higher fees and rates to pay out those profits.

Financial Security

Another common misconception is that big banks offer more security for your money. The reality is that the NCUA (National Credit Union Administration) insures members up to 250k, the exact same amount as the FDIC!

Technologically Inferior

In addition, credit unions offer the same electronic and high tech features that big banks have but with unmatched hometown service, you can only get locally. Florida Credit Union provides members access to their money 24/7 with online banking, a mobile app, and mobile check deposit!

Over 115 million Americans have already made the switch, learn how you can start getting more from your money, with Florida Credit Union, today.