Move Your Credit Card Debt to a Better Card

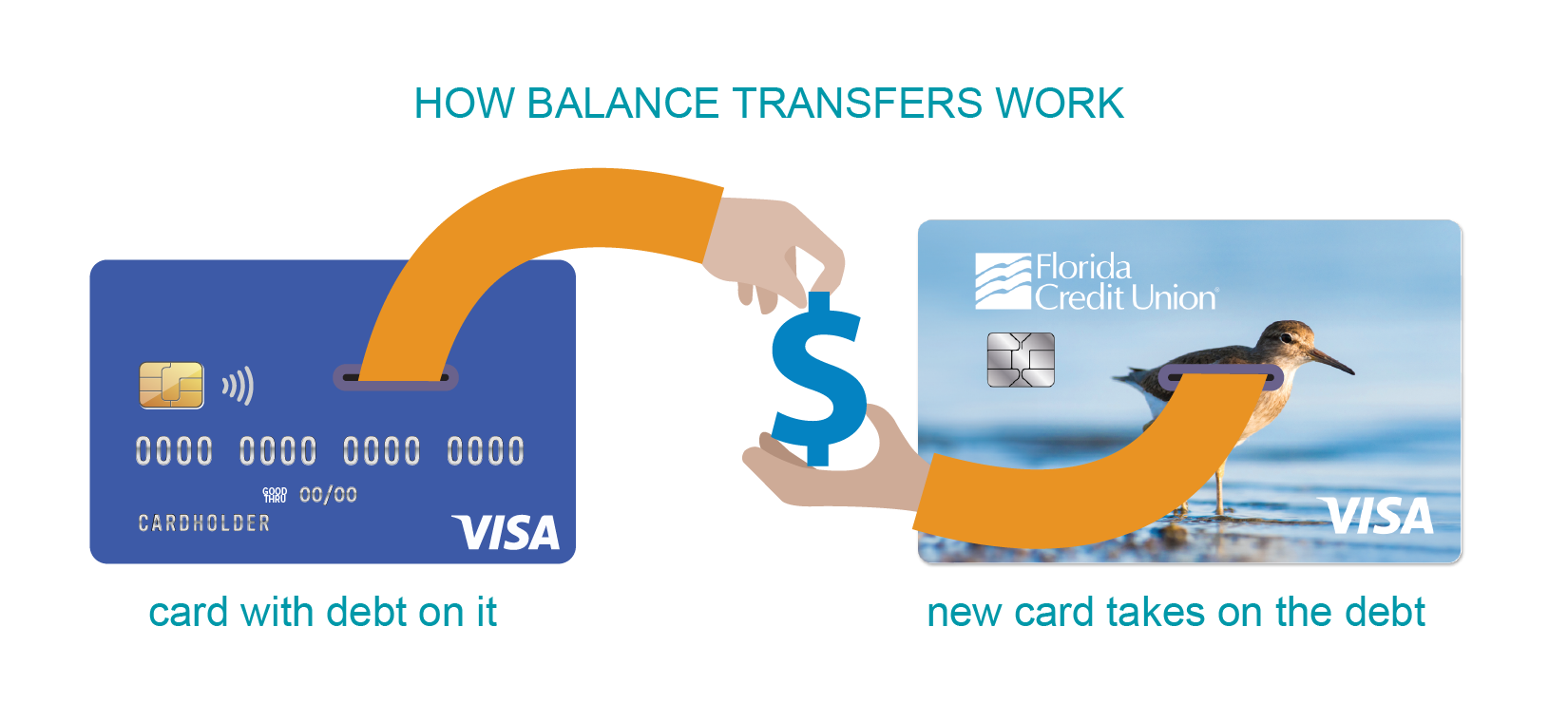

What is a balance transfer?

If you want to pay off credit card debt faster, a balance transfer is a great option1. Consolidate multiple credit cards into one monthly payment, and pay it off faster with a balance transfer to a new or existing Florida Credit Union credit card that features a low rate.

- Pay less interest

- Pay off your balances

- Streamline monthly payments

You could save money by moving your balance from a high-interest credit card to a low-interest credit card.

Here's how our balance transfer process works:

Request a balance transfer by calling us or visiting a branch.

Our team will help your through the process, which may include new FCU membership and/or new credit card opening.

We'll submit a payment to your credit card vendor on your behalf. This payment amount will be added to your FCU card balance.

Once the transfer is complete, you can begin making payments on your FCU credit card.

We recommend monitoring activity on your old card for 1-2 months. This will help you spot accrued interest or unexpected charges.

Get Started Today

Call us toll-free at 1-800-284-1144, visit a branch near you, or send us a message.

Not a Card Holder? Select the Card that Is Perfect for You1!

Balance Transfers Calculators

Balance Transfers FAQs

- Most transfers are processed within a week, but in some cases it can take up to 30 days

- Remember to continue to make payments on cards with other creditors until your balance transfer has posted to your Florida Credit Union account

Interest will begin to accrue from the day the online transaction posts to your account, unless you are within a promotional period.

No, balance transfers do not earn rewards or rebates.

DISCLOSURES

Credit Card Agreement

Opening Disclosures:

Opening Disclosures: Non-Promo

The calculators found on this page are for information purposes only. While the results of the calculators may be generally accurate, the results do not reflect any specific credit union accounts, loans or other products or services and may not exactly match the calculation methods used by the credit union (or any third party) for accounts, loans or other products or services. These calculators should be used only for general informational purposes and should not be relied on for any specific transaction.

1. Subject to credit approval. Your APR will be based on your creditworthiness. Special offers may apply. Click here to see all card options.

APRs on purchases and balance transfers are currently the APRs set forth in the agreements below:

2. Available on select merchant categories. 2% cash back on Gas and Groceries. Florida Credit Union does not have control over the category type a purchase may be assigned to. For example, a large retail outlet may not be assigned a "grocery" code but instead a "retailer" code.